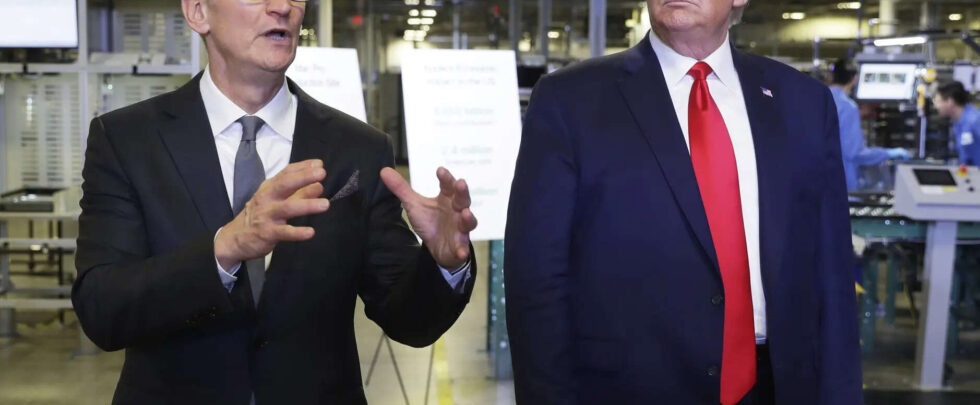

AP

APApple has just taken a massive step forward in boosting U.S. manufacturing. The tech giant announced it will invest another $100 billion in the United States. This new commitment brings Apple’s total planned investment to a staggering $600 billion over the next four years. Apple CEO Tim Cook joined President Donald Trump at the White House to make this big announcement, which has sent Apple’s stock soaring on Wall Street.

What does Apple’s $600 billion US investment really mean?

Apple’s $600 billion investment plan isn’t just a number—it’s a major push to bring more manufacturing back to the U.S. The new $100 billion addition is part of Apple’s ambitious American Manufacturing Program (AMP). This program aims to expand Apple’s supply chain and production capabilities on American soil, including advanced manufacturing processes. The move is designed to reduce Apple’s reliance on overseas manufacturing and create more high-tech jobs in the U.S. Apple plans to work with many American companies such as Corning, Coherent, Applied Materials, Texas Instruments, and Broadcom to build key parts and materials domestically. One standout deal is the $2.5 billion investment with Corning to produce 100% of iPhone and Apple Watch glass in Kentucky. This facility will feature the world’s largest and most advanced smartphone glass production line and an Apple-Corning Innovation Center.

How will this impact jobs and the American economy?

This massive U.S. investment isn’t just about products; it’s about people and jobs. Apple is set to hire around 20,000 new employees in the U.S. over the next four years. These hires will be focused on research and development, silicon engineering, software development, and artificial intelligence—all cutting-edge areas. This move is expected to give a real boost to the American economy, particularly in manufacturing sectors that have seen decline over the years. With more advanced manufacturing happening domestically, Apple hopes to build a resilient supply chain that can withstand global disruptions. The initiative also aligns closely with President Trump’s “America First” economic policies, which emphasize growing U.S.-based production and reducing dependence on foreign suppliers.

Why is Apple investing so heavily in US manufacturing now?

There are several reasons behind Apple’s big investment push in the U.S. For one, global trade tensions and tariffs have made overseas manufacturing more complicated and expensive. By increasing production in the U.S., Apple can avoid some of these trade-related costs and risks. Moreover, customers and governments worldwide are paying more attention to supply chain security and sustainability. Bringing manufacturing closer to home helps Apple improve oversight and reduce its environmental footprint. Finally, investing in American manufacturing supports innovation, as close collaboration between engineers and factory workers accelerates new product development.

How did the stock market respond to Apple’s announcement?

Wall Street responded enthusiastically to Apple’s news. The company’s stock price jumped nearly 5%, adding roughly $140 billion to its market value in just one day. Investors see Apple’s plan as a smart way to secure its supply chain, avoid tariffs, and tap into the growing push for domestic production. This stock surge reflects confidence in Apple’s leadership and long-term strategy. It also shows that the market values companies willing to invest big in U.S. manufacturing and innovation, especially amid ongoing global economic uncertainties.

What does this mean for Apple’s global supply chain strategy?

While Apple is ramping up its U.S. manufacturing, it’s not abandoning its global supply chain. Instead, the company aims to balance production across different regions. By diversifying where products and components are made, Apple can better handle disruptions like those caused by the pandemic or geopolitical tensions. The new American Manufacturing Program adds an important layer of resilience to Apple’s operations, making the supply chain more flexible and secure. This strategy keeps Apple competitive in a world where manufacturing agility is more important than ever.

FAQs

Q: What is Apple’s American Manufacturing Program?

A: It’s Apple’s $600 billion plan to expand manufacturing and supply chains in the U.S., creating jobs and building advanced facilities.

Q: How did Apple’s stock react to the investment announcement?

A: Apple’s stock jumped nearly 5%, reflecting strong investor confidence in the company’s U.S. growth plans.

(Catch all the US News, UK News, Canada News, International Breaking News Events, and Latest News Updates on The Economic Times.)

Download The Economic Times News App to get Daily International News Updates.

...moreless